Very first responders face punctual-moving alterations in demand, recommendations and you will degree, and physical and mental fret which leads to health problems and you will burnout.

Good 2021 EMS1 survey located more than half out of respondents when you look at the EMS works more than one occupations. Of the over 900 participants, 63% stated working more 50 instances each week, which have 21% performing more 70 hours a week.

Home loan applications to have first responders

This type of New Castle installment loans finance try common specifically among very first-big date homeowners by program’s flexible down payment arrangements and you may everyday credit score conditions.

Very first responders just who qualify for this plan may be permitted to set the absolute minimum down payment as little as 3.5%.

- You have steady a career for a few years, essentially with the same employer

- You merely have less than just a couple 30-day late payments over the past 24 months

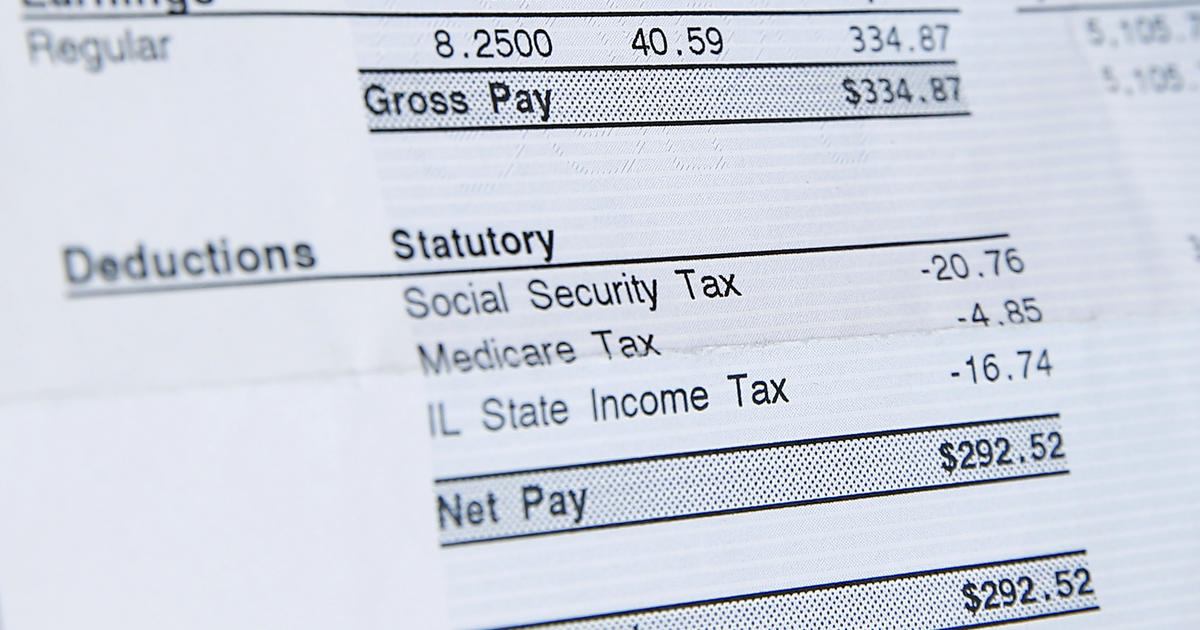

- 30% of your gross income can be obtained for layer home loan repayments

- Their month-to-month personal debt will not surpass 43% of the month-to-month income

- You are looking for maintaining reasonable monthly premiums

Credit score standards can be subject to transform. The newest previous COVID-19 pandemic triggered of numerous home loan traders getting stricter along with their underwriting guidelines, particularly for bodies fund.

Good-neighbor Next-door are home financing program because of the U.S. Department regarding Construction and you may Metropolitan Creativity (HUD) open to societal servants, plus very first responders. This method allows accredited people to buy residential property in revitalized teams.

The nice Neighbors Next door System enables you to get a beneficial family getting 50% of your appraised worth predicated on where in fact the residence is located.

To join, you should follow brand new HUD’s system regulations and meet with the very first responder requirements. Is eligible, you need to be employed full-big date once the an excellent firefighter, EMT, paramedic or the authorities manager by the a fire company, EMS unit otherwise the police department of one’s Federal government, your state, an excellent device out-of standard local government otherwise an Indian tribal authorities, serving on locality where in fact the home is found.

In the event that numerous somebody submit an application for an identical assets, a randomized lotto might be stored to choose which applicant gets to get a profitable render.

Va loans have no deposit requirements. As well, accredited individuals do not need to purchase home loan insurance, as opposed to which have FHA mortgage arrangements. These features build Va loans perhaps one of the most glamorous mortgage software for sale in the industry.

Together with earliest responders with past armed forces service, Va financing can also be found to have active-obligations provider members, certified partners or other pros.

- You otherwise your lady served 181 days during the peacetime otherwise 90 consecutive months inside wartime

- You or your wife supported getting half dozen many years on the Federal Guard or Reserves

- Zero prepayment charges

- Individuals normally show closing costs to the supplier

- Refinancing is available up to a hundred% of your own residence’s value

The fresh new Va inspections funds to make sure borrowers don’t get its features foreclosed. Likewise, new Virtual assistant even offers a repayment plan should you decide encounter commission things.

Particular regional municipalities render down-payment guidance. There are even particular loan recommendations apps from the condition top that can help earliest responders.

Inside Tx, such as for example, there can be a houses to have Texas Heroes Program provided by the brand new Texas Condition Reasonable Housing Enterprise. This method can be obtained having earliest responders, productive or veteran army professionals and you will university pros.

Specific lenders . For people who imagine bringing down payment help from your regional condition otherwise society, research throughly first before applying.

Check to see if you be eligible for property guidelines

Mortgage software come on bodies, state, and you may regional accounts. Any of these arrangements, particularly the condition and you will local software, are very different of the urban area. If you find yourself a first responder searching for applying for particularly applications, check with your condition or state regarding the options. Review for each system to determine hence option is a great fit for your official certification and you may monetary strength.

Look at the FHA, HUD otherwise Va other sites, otherwise your regional country’s casing system facts online. You may want to consult home financing consultant to learn more about mortgage brokers.

You may have an abundance of challenges and commitments since the an initial responder. Hopefully one among them mortgage software renders our home to shop for process a tiny simpler.