Homeownership when you look at the Colorado just will bring a spot to label house but offers the opportunity to build guarantee. When you’re a resident seeking influence the fresh new equity you mainly based, House Equity Financing (The guy Loans) and you will Home Equity Credit lines (HELOCs) was strong economic gadgets to take on. Inside guide, we shall talk about brand new particulars of He Financing and HELOCs, getting information to have Colorado owners interested in unlocking the significance for the their houses.

Knowledge Domestic Guarantee

Household security was an excellent homeowner’s demand for their house, symbolizing the difference between the fresh home’s market value together with an excellent home loan balance. In Texas, in which assets philosophy may experience movement, insights and you may leverage so it equity is vital to and make informed monetary choices.

When considering being able to access house security, several top choices are Home Guarantee Fund (The guy Finance) and you may Household Security Lines of credit (HELOCs). The guy Funds render a lump sum payment amount which have a predetermined interest rates, making them perfect for structured expenditures like household renovations. On the other hand, HELOCs render a great rotating personal line of credit, providing liberty to own lingering means such as for example education expenses otherwise unanticipated will set you back. Texas residents is always to very carefully believe the economic wants before choosing between this type of solutions.

Qualification Requirements for He Finance and you may HELOCs during the Tx

So you’re able to qualify for He Money or HELOCs in Colorado homeowners typically you need an effective credit rating, a fair loans-to-earnings ratio, and you can enough guarantee within their homes. Local loan providers, such as those towards Morty’s platform, also provide customized suggestions press the site centered on private monetary facts plus the unique regions of this new Colorado real estate market.

Tips Apply for He Loans and you may HELOCs

The application procedure to possess The guy Loans and HELOCs comes to gathering documentation, such as for instance proof income and you may possessions valuation. Texas residents will benefit out of working with local mortgage officials who comprehend the subtleties of your own state’s real estate market. Morty, an on-line mortgage broker, connects individuals which have regional loan officials, ensuring a customized and you may effective software processes. Having Morty, people might even feel a quick closing, to the potential to romantic toward a good HELOC within the very little while the 14 days.

Choosing Loan Number and Rates of interest

The mortgage number and you may interest rates for The guy Loans and you will HELOCs trust various things, such as the number of equity, creditworthiness, and you will market criteria. Tx residents may benefit throughout the competitive rates given by local lenders, specially when making use of online systems particularly Morty one to improve the credit processes.

Preferred Purposes for He Loans and you can HELOCs

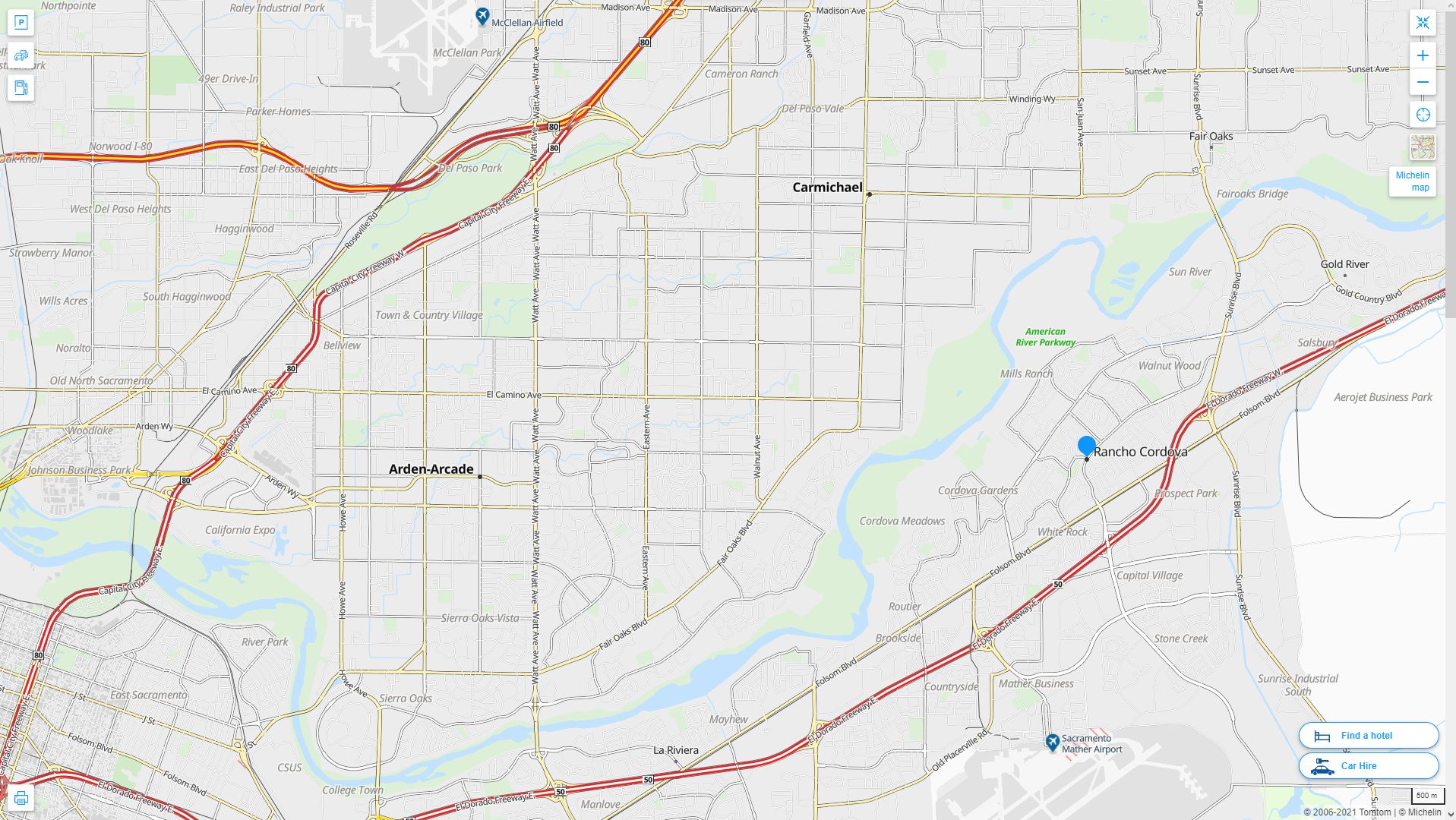

Tx property owners will explore The guy Funds or HELOCs for several purposes. They might boost their homes within the parts particularly Denver’s LoDo, Colorado Springs’s Dated North end, or Boulder’s Pearl Roadway Shopping center, improving value of. They could including combine expenses to simplify profit or safety tall costs such as college fees or medical bills. Some homeowners in the Texas actually put money into rental qualities into the parts like Fort Collins otherwise Aurora to increase the income. With practical prices and versatile terms, these finance let Texas property owners reach the economic needs and you will bundle for the future.

Considerations

As he Fund and HELOCs give high benefits, it’s critical for property owners to understand perils. In control fool around with is key, and you may knowing the conditions, prospective changes in interest rates, in addition to chance of property foreclosure in case of percentage default is actually very important. Local financing officers, available due to Morty, provide tips on responsible credit.

Unlocking home collateral by way of He Money otherwise HELOCs for the Texas requires careful consideration and told choice-while making. By understanding the differences between these alternatives, talking to local loan officials, and using on the internet programs eg Morty, home owners is also leverage the security to get to the monetary requires responsibly. Contemplate, the main is to try to line up this type of economic tools with your unique circumstances and you can desires.

When you need to be delivered to help you a local financing administrator in your area, would a merchant account for the Morty today! No tension, totally free, simply higher regional assistance and support!