- Bio/Trial Information

- Work Records

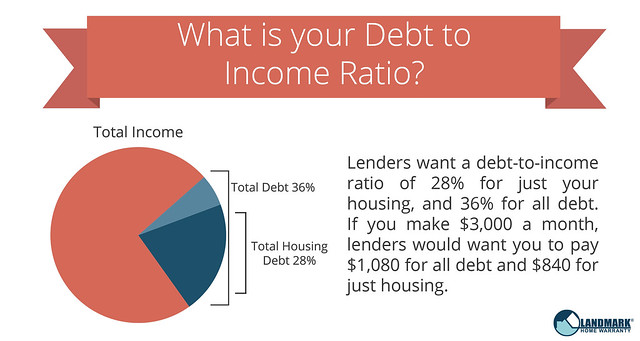

- Economic Guidance

- Resource

Faqs From the College loans

U.S. Citizen – An individual who grew up in the united states, such as the straight down 48 states, Alaska, The state, Puerto Rico, Guam, additionally the U.S. Citizen mothers lower than being qualified products (derivative citizenship) and you will who has perhaps not renounced U.

S. citizenship

Permanent Citizen – Any individual perhaps not a citizen of your You that is staying in the brand new You.S. best personal loans Kansas under legally recognized and you will lawfully recorded permanent home as an enthusiastic immigrant. Labeled as “Long lasting Resident Alien,” “Lawful Long lasting Resident,” “Citizen Alien Enable Holder,” and you will “Green Cards Proprietor.”

- The first borrowing from the bank review is dependent on breakdown of all advice both you and your cosigner (if the relevant) bring in the application processes therefore the pointers obtained from your own credit file(s). For people who admission the initial borrowing from the bank opinion, attempt to provide acceptable paperwork like your earnings confirmation and you may Candidate Worry about-Certification Function and we’ll need the qualification out of your school until the final financing recognition.

- The modern repaired interest levels may include 2.99% to seven.38% in essence at the time of eight/6/2023. The brand new repaired interest rate and you will Annual percentage rate (APR) could be highest based upon (1) this new student’s and cosigner’s (if the applicable) credit histories (2) the newest payment option and you can loan name selected, and you can (3) brand new requested loan amount or other recommendations offered to your online application for the loan. If the accepted, applicants was notified of the price entitled to during the mentioned range. APRs may include 2.74% (with Car Shell out Discount5) to six.89%. The Annual percentage rate shows the fresh estimated total cost of loan, including upfront charge, accruing focus as well as the effect of capitalized focus. A minimal ple takes on a beneficial $ten,000 loan paid in one purchase; the highest ple assumes an excellent $10,000 mortgage disbursed more a couple transactions. The lowest current Apr, based on an effective 5-season fees title (60 weeks), a primary cost package, month-to-month prominent and you may attention repayments off $, has a two.74% rate of interest with an excellent 0.25% interest rate protection having payments through vehicle shell out 5 . The best latest Apr, based on an excellent fifteen-12 months installment term (180 weeks), a deferred installment bundle with a great deferment age sixty days abreast of first disbursement, a six few days grace several months before cost starts, month-to-month dominant and focus money out-of $, features an seven.38% interest. Brand new repaired interest allotted to a loan can’t ever changes except as needed by-law or you request and qualify into the ACH prevention work with(s) otherwise Graduation award. Payment terms and conditions and available options ount borrowed.

- Program financing may be used to coverage educational costs for instructional episodes you to finish to help you 3 months prior to the app big date.

- Pupil consumers which earn good bachelor’s training or more gets a good 0.25% interest rate reduction if (a) he’s generated just about you to (1) late percentage (more 10 weeks late) for the financing, (b) they consult the advantage throughout the servicer in a single (1) seasons once graduation, and you can (c) they offer proof graduation towards the servicer. The fresh new student must consult so it work with through phone otherwise mail and you may must provide either a certified backup from a diploma or good certified transcript. Abreast of the newest servicer’s review and you may anticipate of one’s student’s paperwork, the fresh new servicer shall upload a verification page stating that brand new graduation work for has been granted.

- Mortgage decrease in 0.25% can be found to own borrowers just who generate monthly digital loans import (EFT) costs regarding prominent and you may focus out of a discount or bank account. So you’re able to be considered, the fresh borrower has to strategy on financing servicer so you can automatically subtract monthly prominent and you will attention payments of a checking account. Brand new automated payment work with will discontinue and get destroyed to your left fees period although one about three repayments was returned to have decreased money over the longevity of the mortgage. That it benefit is not readily available for interest money produced in deferment period toward Attract Merely Installment option. This work for is generally terminated throughout the deferment and you may forbearance episodes, but can feel lso are-created if the borrower reapplies at the end of brand new deferment otherwise forbearance several months.