Chloe Moore, CFP, is the creator regarding Financial Basics, an online, fee-only economic think firm-based during the Atlanta, GA, and you may providing website subscribers all over the country. Their unique corporation are intent on helping technology professionals inside their 30s and you can 40s who will be business-minded, philanthropic, and you will mission-driven.

Lenders use fico scores to measure creditworthiness. An effective FICO get from 580 otherwise lower than puts a borrower during the the indegent borrowing class, showing greater risk. However, with a credit history inside range does not always mean you happen to be completely shut-out of getting a loan if you like you to.

You may have certain solutions if you’re looking to have loan providers that offer signature loans getting a good 550 credit score. That’s soothing to understand if you want to borrow money to cover an economic emergency otherwise need to get a little loan to repay in order to reconstruct your credit history.

I researched additional lenders to obtain of them one to stretch signature loans so you can borrowers with down fico scores. Learn where you’ll get a personal loan with a good 550 credit rating, what is required for approval, and choice borrowing from the bank choices.

Best unsecured loans to possess 550 credit score

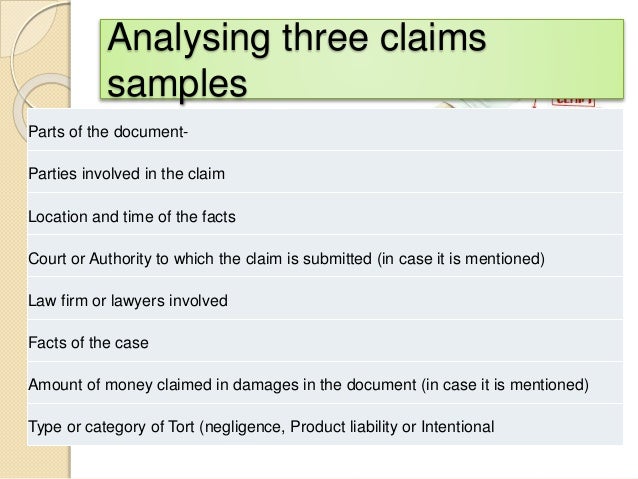

We now have place about three ideal loan providers and mortgage marketplaces beneath the microscope so you’re able to choose which is best suited for your circumstances.

Reliable Most readily useful markets

- Wide variety of loan providers

- Convenient rate evaluations

- Effortless application processes

Reliable stands out since the an excellent marketplace for signature loans, for even borrowers which have an excellent 550 credit score. It permits pages to compare rates off various other loan providers in one single system.

Leveraging the comprehensive network, possible consumers normally complete one application and possess prequalified rates-all instead harming their credit rating through a difficult credit score assessment. This makes Legitimate outstanding place to begin men and women trying a good personal loan.

Upstart Ideal for nothing-to-no credit

- Cost are derived from degree and you will work background

- Brief decisions and next-big date funding

- Zero prepayment charges

Upstart is very good for assisting people with virtually no credit histories. Unlike relying solely for the credit ratings, Upstart takes into account educational history and you may job history when deciding loan terminology and you may rates.

This process can often end up in a lot more fair rates to own consumers who may have become penalized by more traditional credit metrics. Combined with quick decision minutes and next-time money, Upstart provides just the thing for those new to credit.

When you get signature loans having credit ratings around 550?

Personal loans provide the means to access dollars speedycashloan.net/payday-loans-wa/ if needed, but it’s crucial that you understand what you’ll receive. With a credit rating from 550 or lower than could affect the new financing terms you can easily qualify for, including:

- How much you’ll be able to obtain

- Loan rates and you may charges

- Payment conditions

Contrasting advantages and drawbacks and you may what you would like the cash having helps you decide if personal loans to possess an excellent 550 credit score make sense. Additionally, it is beneficial to envision some solutions to personal loans when the you are not capable of getting good credit choice.

Pros and cons off personal loans in case the credit rating is 550

Good 550 credit score is not a complete barrier to help you approval, because there are loan providers one expand funds with lowest (or no) minimum credit history conditions.

It could take just moments to apply for an effective consumer loan on the internet and get approved, which includes loan providers providing funding as quickly as another business time.

A credit score from 550 or less than can lead to an excellent large rate of interest towards the mortgage otherwise a larger origination percentage, whether your bank charge you to definitely.

You might be limited to bringing a smaller financing, which could be a drawback when you have more substantial economic you need.