A combined financing gives co-borrowers equivalent use of the borrowed funds fund otherwise one investment purchased into financing, and mutual equal obligations having expenses they straight back.

On this page:

- How does a mutual Mortgage Really works?

- Positives and negatives from Shared Funds

- Just how Taking out fully a combined Mortgage Is different from Cosigning

- How come a joint Mortgage Affect Your credit score?

A mutual financing is not a specific form of mortgage but alternatively the procedure of co-borrowing a loan and revealing equivalent obligations into money that have other people. Since the for each and every applicant’s credit scores, money or any other factors are typically noticed, it can be better to qualify for a combined loan. However, joint funds try not to been rather than threats. Before signing up, here are some just how joint fund really works or any other a few in advance of co-borrowing from the bank.

Why does a joint Financing Work?

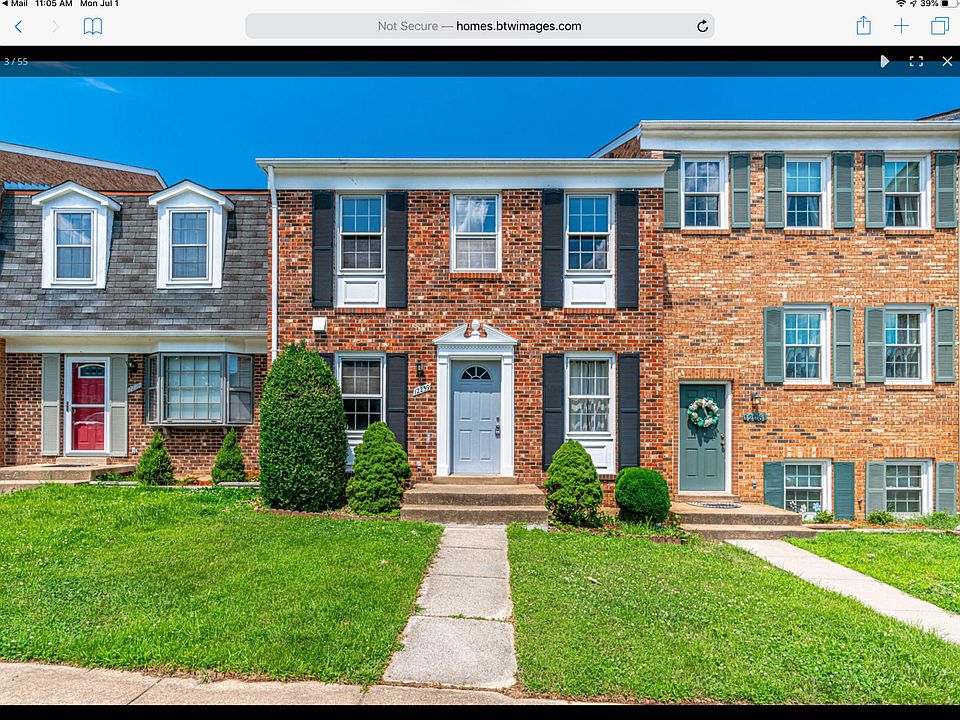

When you are to purchase property, money an automible, purchasing a married relationship or and then make a unique large pick, it may be tough coming up with the bucks you need to pay for bill. Without the discounts to pay for rates, that loan can be necessary. If you were to think you might not qualify for the borrowed funds in your own, a shared loan could be recommended.

When you take aside a joint mortgage, youre co-credit the funds-pooling their information-with one individual or higher, instance nearest and dearest, a partner otherwise pal. You incorporate while having recognized towards the mortgage to one another consequently they are just as guilty of making the loan payments. You additionally show shared possession of your financing fund or perhaps the resource purchased toward financing.

One another the term and your co-borrower’s name can look for the most of the mortgage data. Rather than only using you to definitely applicant’s money and you will credit information to help you meet the mortgage standards, although not, lenders use for every applicant’s income, credit score or any other factors to have recognition. Regarding home financing, most of the brands will for the property’s identity. The same relates to co-running an auto or other asset.

Your own financial will get enable you as well as your co-debtor to prequalify toward loan. You will see your rates, conditions and you will payment per month count without one inside your credit scores. Prequalifying along with provides you with the ability to examine proposes to pick the best mortgage to meet your needs.

Advantages and disadvantages regarding Combined Finance

- You could potentially share the responsibility which have a separate co-debtor. Because you plus co-debtor is one another responsible for deciding to make the payments into the financing, you don’t have to defense the costs alone. To make to your-big date repayments per month can also help improve both of your credit ratings.

- You have got greatest approval chance. When you yourself have reduced-than-excellent borrowing, low income or the debt-to-earnings ratio is higher, you have best likelihood of qualifying for a financial loan and you may securing a better manage an effective co-borrower that has a high credit rating, high money and lower loans-to-earnings ratio.

- You could qualify for a higher loan amount. Two or more incomes ount. This is because lenders feel the extra warranty you might meet the monthly payments plus loans would be paid down.

Although a mutual loan with a good co-borrower helps it be more straightforward to be eligible for that loan or mortgage and perhaps also increase credit, what’s more, it has disadvantages to consider.

- You are both accountable for the debt. Given that both your term along with your co-borrower’s title are on the loan contract or term, your show equivalent responsibility towards the fees of loan. Thus, whether your co-debtor cannot (otherwise wouldn’t) improve costs, your deal with complete obligations to own installment loans Magnolia paying the complete loans. You’ll also guess one later charge or range will cost you.

- You can even place your credit history at stake. With a joint financing, you are equally accountable for the mortgage money. In the event that you either or your co-debtor falls at the rear of in your payments, credit scores for individuals usually takes a hit. On the other hand, and work out to your-day payments monthly can boost fico scores for both membership people.

Exactly how Taking out a combined Loan Is different from Cosigning

Regardless of if co-borrowing from the bank and you can cosigning show a number of the same obligations and you can dangers, there are some trick variations. When taking away a mutual mortgage, you will be co-borrowing from the bank which have a minumum of one anyone, so that you possess equal responsibility and you can ownership rights because co-individuals. But cosigning only will give you liability to your costs-maybe not ownership.

As an instance, anybody in place of centered credit can use good creditworthy cosigner into the a loan. As the cosigner try legitimately in control to invest straight back the mortgage if the first debtor do not, they have zero rights into loan proceeds-however, co-consumers perform.

How does a joint Financing Connect with Your credit score?

Depending on how your control your shared mortgage, the borrowing from the bank are possibly aided otherwise hurt. Missing repayments or defaulting on your loan can be hurt each other your credit score along with your co-borrower’s. However, really loan providers will statement late payments when they is located at least 30 days overdue. Very, you have got a touch of respiration room to bring your account newest.

After you sign up for a joint financing, your own lender will do a credit assessment one results in a hard borrowing from the bank query for individuals. This may lead to a dip in your credit rating and your co-borrower’s rating. Normally, this is short-term, yet not, plus the miss will protect against over the years.

The conclusion

Taking out a shared financing which have a pal, partner otherwise loved one has many professionals over making an application for a good mortgage oneself. But it also comes with the chance of injuring your borrowing from the bank for many who skip repayments or default to your financing.

A leading credit rating will bring you a knowledgeable mortgage prices and you may terminology, very look at your credit score and you can statement free of charge which have Experian observe where you are. You are able to rescue committed contrasting you can lenders by the playing with Experian’s 100 % free research unit, that allows you to examine mortgage even offers customized on the borrowing character. Getting time for you to change your borrowing from the bank before taking out an excellent financing is the better cure for secure a great terminology and you may good low interest.

It’s the perfect time for that Financing

Whether you are interested in a motor vehicle otherwise keeps a past-second costs, we could match one to mortgage also offers you to work for you and you may funds. Begin by your FICO Get free of charge.