But not however for brand new so you’re able to financial customer, it needs some time, should undergo a tight underwriting/recognition process

5. Always Promote Right InformationCorrect, factual recommendations increases the possibilities of approval towards the even more favorable terminology. But any not true otherwise incorrect advice commonly produce the application are denied since the on line loan providers uses numerous digital offer to help you ensure the accuracy away from details.

Designed for several objectives depending on criteria, quick unsecured loans, no real go to required at the part, it is simply a click on this link out.

The minute fund will likely be availed on the internet both from individual loan also offers out of traditional banking institutions otherwise out-of fintech businesses. When you find yourself unsecured loans away from banks before got weeks or weeks so you’re able to techniques, but now having established people, the net banking otherwise cellular software studio assurances these could getting procured speedily.

Where private banking companies are concerned, they offer get a hold of users personal loans within short while. Of several render pre-recognized finance to help you much time-date people having an effective fees listing and you will suit credit scores. If a prospective borrower provides a functional checking account and you may repaired salary/income, the person can apply to own an unsecured loan. And typical KYC files, no extra paperwork are expected. Immediately after accepted, the fresh disbursal will happen from the basic for a passing fancy date.

However, new-many years fintech entities is advantages in the disbursing quick money contained in this couples moments in the event that a candidate provides all of the related details/files. Be it legacy banks or this new-many years lenders, individuals is look at their quick mortgage eligibility on the internet through the alarmed webpage. Modern age fintechs promote on the road money that have effortless software process, designed underwriting/AI established decisioning, and you may digital documentation

The attention rates on the instantaneous signature loans differ across loan providers, depending on your credit rating and you may repayment habits. If you have an ongoing consumer loan having a lender, you could potentially take advantage of an instant better-up loan towards the existing count. Again, discover minimal files and you can quick disbursal. High-risk users may also come down loans to utilize according to the requirement and then repay with ease. This will help in building borrowing from the bank profile otherwise improving the present terrible credit rating.

Banking institutions, NBFCs, and you can the fresh new-age financing networks bring immediate finance anywhere between Rs 15,000 so you can Rs 10 lakh rate of interest, utilizes brand new customer’s risk reputation and credit rating.

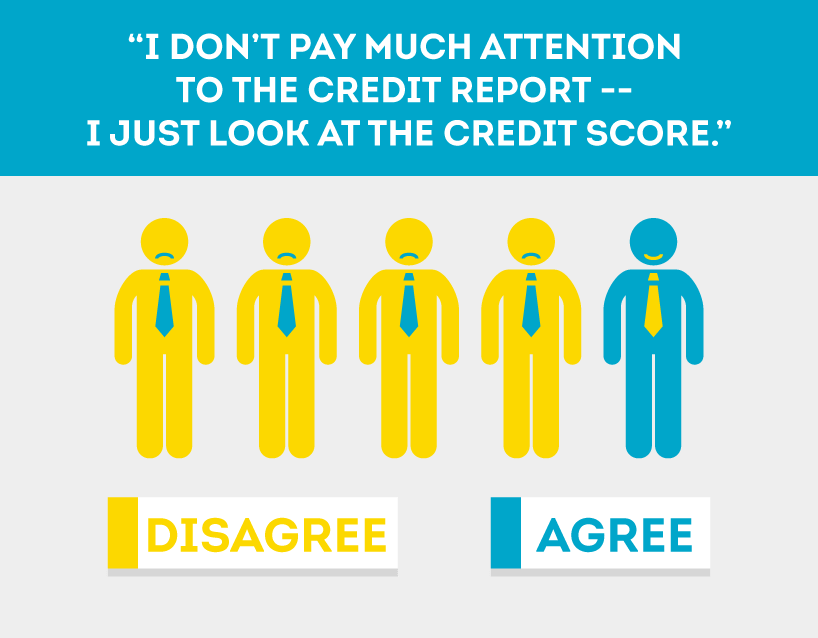

Listed here are five best tips to improve probability of acceptance to suit your instant mortgage online: step one. Manage a healthy Credit score A credit rating away from 750 and you can significantly more than is essential for your immediate financing application’s approval. The financing rating shows your borrowing from the bank incorporate and you can repayment record. A beneficial rating indicates you will be making quick payments and they are a credit-worthy consumer. No matter if consumers which have a lower life expectancy credit score can nevertheless be offered an instant financing, the attention costs is actually highest. The greater the fresh new rating, the more your odds of recognition to the favorable words.

dos. Figure out their Qualification and requires ahead of ApplyingDifferent lenders provides different eligibility conditions. Have a look at these to be sure you are eligible. Comprehend the unsecured loan number you’re looking for and you can calculate this new EMI you can pay back conveniently if you’re choosing the best suited period. Personal bank loan hand calculators come on the internet, letting you understand the possible EMIs getting particular quantity and tenures. Never ever get more what you want regardless if eligible.

3. Keep the Data Happy to Publish BeforehandAll called for documents such financial comments, address and you may ID facts, pictures, etcetera. is going to be ready to own uploading  once you availability the newest lender’s webpage having a fast loan. Before applying, it’s wise to store this type of photos on your equipment to save time. And therefore, the net application for the loan process shall be done instead crack inside times. Some programs have the brand new business to-do KYC confirmation compliment of digital setting in which the KYC facts are fetched away from completely new supplies while won’t need to bring any additional information. It is necessary which you give proper info to verify because of this process.

once you availability the newest lender’s webpage having a fast loan. Before applying, it’s wise to store this type of photos on your equipment to save time. And therefore, the net application for the loan process shall be done instead crack inside times. Some programs have the brand new business to-do KYC confirmation compliment of digital setting in which the KYC facts are fetched away from completely new supplies while won’t need to bring any additional information. It is necessary which you give proper info to verify because of this process.