If you find yourself searching for delivering funding to construct or reily residential property, bringing an FHA/HUD 221(d)(4) loan can be one of the most affordable a way to get it done. But, to track down a keen FHA/HUD 221(d)(4) financing, you’ll want to create high thinking.

- Trying to get Multifamily FHA/HUD Funding

- Exactly what You’ll want to Sign up for an enthusiastic FHA/HUD 221(d)(4) Mortgage

- Exactly what Necessary for a strong Relationship

- Seeking a keen FHA Registered Lender

- To learn more about HUD 221(d)(4) financing, just complete the proper execution less than and you may a HUD mortgage specialist will get connected.

- Related Concerns

- Rating Funding

Making an application for Multifamily FHA/HUD Capital

While you are looking for bringing funding to construct or reily domestic property, delivering an enthusiastic FHA 221(d)(4) mortgage is usually the most affordable a way to exercise. However,, locate a keen FHA/HUD 221(d)(4) financing, you’ll need to perform high preparing.

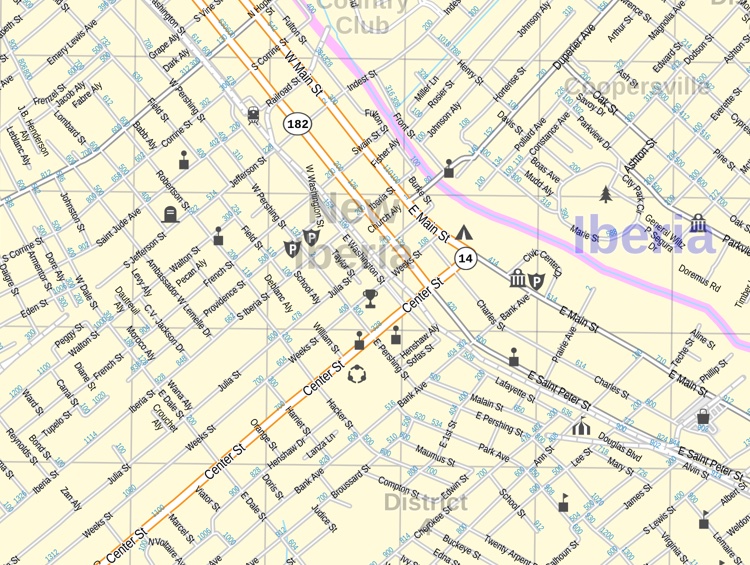

The initial part of the FHA/HUD 221(d)(4) loan application techniques is known as pre-application. With this part of the processes, you’ll need to promote Danbury loans their HUD workplace with many details about your project, along with a general breakdown of your project, Means HUD-92013, Application having Multifamily Property Opportunity, the latest resumes of one’s proprietor, trick principals of one’s investment, place maps, webpages plans, pictures, environment assessments, plus a number of almost every other HUD variations and you may data.

Next an element of the HUD 221(d)(4) loan application process is known as enterprise connection. So far, the latest HUD gave general approval towards the venture depending whatever they currently discover, nevertheless they still have to pick a whole lot more documents just before everything is set in stone. To successfully pass the business union way to full financing approval, you may need documents as well as a good transmittal page and an application to have Multifamily Casing Venture (Setting HUD-92013) with a charge of $step three for every $1000 off mortgage. As well as, you will additionally need pass an enthusiastic intergovernmental feedback. While doing so, you really need to contact your regional HUD place of work observe who you need certainly to get in touch with regarding the condition the spot where the house is discovered (of course any additional analysis are essential).

Likewise, you’ll need to submit Byrd Amendment records, that’s intended to make sure no illegal lobbying or lobbyist-established disputes interesting will likely exist because of this of project. And you may, you will need certainly to submit Form HUD-92013, for which you need certainly to divulge one present legal actions away from events mixed up in investment. This is particularly important if your litigation is actually pertaining to unpaid federal obligations.

The new FHA/HUD 221(d)(4) application for the loan techniques is fairly complex– and you can borrowers have to submit a great deal more versus records we have said here. To see the full set of files you will need to apply for an FHA/HUD 221(d)(4) financing, go to the FHA/HUD 221(d)(4) financing record.

Think about, along with delivering all your records and you can recognition regarding HUD, you’ll need to discover a keen FHA signed up bank, constantly before starting the latest acceptance process. You should remember that the newest FHA/HUD simply ensures the mortgage, that’s not in fact accountable for loaning the newest debtor any cash. Therefore, it is best to discuss any project having multiple FHA authorized lenders, so you’re able to know a little more about process and the advantages and drawbacks of possible lenders.

Exactly what are the eligibility criteria having FHA multifamily design financing?

- You need to be a towards-profit entity or a non-profit organization.

- You’ll want a minimum of 2 yrs of experience from inside the developing and you can/otherwise managing multifamily homes.

- You truly need to have a minimum of couple of years of experience during the developing and you can/otherwise managing multifamily construction.