In some instances, going through the period between paydays is actually challenging, and an instant payday loan could offer a means to endure. Earnings manufacturer USA try a payday loan provider in the US, it is it your best selection of system?

In this thorough breakdown of the platform, we are going to take a look at its service, essential services, merits and demerits.

By the end in the assessment, you’ll be capable of tell if it is the best one for you. Continue reading which will make the best choice.

About web page:

- Debts From $100 to $15,000

- Instant Program & Endorsement

- Bad Credit Considered

- Lenders From All 50 all of us Says Onboard

What exactly is Cash Manufacturing Plant USA?

Earnings plant United States Of America is a direct loan provider providing usage of financial support in 9 US reports. It includes two biggest short-term funding options and attempt to be clear in their dealings. Their business headquarters have nevada, Nevada.

Advantages and disadvantages of a Cash Factory USA Loan

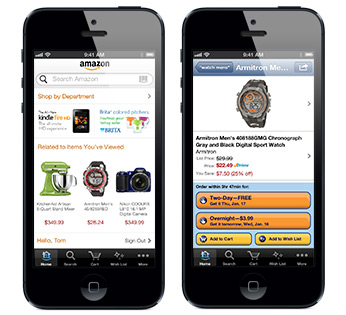

Clear charge structure You’ll be able to cancel the loan without having to pay any charges Lender has actually a mobile app quickly loan acceptance and capital Extremely high interest levels The company produces little information regarding itself Services are just found in 9 says minimum loan restrictions

Profit manufacturing plant American vs other aggressive creditors

Cash Factory try an online payday loan loan provider known for their visibility and lenient payments terms and conditions. The borrowed funds software processes is performed online where borrowers are able to see the cost break down of their unique loans such as some other related charges. But their immediate competitors like Advance The united states, Opploans, and surge Credit will also be a force to reckon with in this industry. Why don’t we observe how they all contrast regarding financing maximum, credit rating requirement, interest levels, and repayment course.

Gives financing limit of $100 to $1,000 No minimum credit rating called for passion prices extend between 207.7per cent to up to percent with regards to the condition of house payment period from 14 days as much as six months financing restrict begins from $100 to $5,000 Requires a credit history of above 300 for almost any $100 borrowed a pursuit of $22 try sustained regular and monthly payback installments Borrow limit $500 to $5,000 less than perfect credit rating is permitted Annual installment rates begins from 99percent to 199percent Payback time period 9 to three years Grants loan from between $500 to $5000 Bad credit rating is actually permitted Annual rate begins from only 36per cent to up to 299per getbadcreditloan.com/payday-loans-al/birmingham/ cent The payment phrase range from 7 to 26 months, based on county of residence

How exactly does a money manufacturer United States Of America loan perform?

Finances plant United States Of America supplies service within just a number of claims, in the shape of payday and short-term installment loans. These differ in amounts, which range from $100 to $1,000.

The amount you have access to through the loan provider will mainly depend on your state of property and individual situations. Loan words lasts from a couple of weeks to half a year of these financial loans.

Among its leading features is that the web site sets blank all the information you want about the borrowing from the bank bills. This can be unlike most short term loan providers. Exactly who only allow you to understand rates once you submit the application processes.

Increasing the openness would be the fact that they offer numerous samples of loans and potential bills from inside the different claims in which they offer treatments.

Another highlight is the reality that after borrowing from the platform and obtaining funds, there is the solution of coming back the funds. If you get in contact with the team within a span of just one to 3 time after getting the circumstances, you’ll send it back without paying any fees.