Thinking steps to make your dream out-of homeownership a reality? Now we shall end up being talking about down-payment recommendations apps as well as how they could make it easier to overcome one of the greatest obstacles in order to to shop for a property: saving upwards to possess a down-payment and closing costs! Many Arkansas homeowners try amazed to understand there are a variety off deposit programs available – over dos,000 in the us! Enough family consumers dont even sign up for people assistance, of course, if they’re not going to meet the requirements. They could feel just like its a lot of work, rather than also worth the difficulty. Lenders want to get more individuals towards the home, that kinds of apps can help, providing you see eligibility requirements.

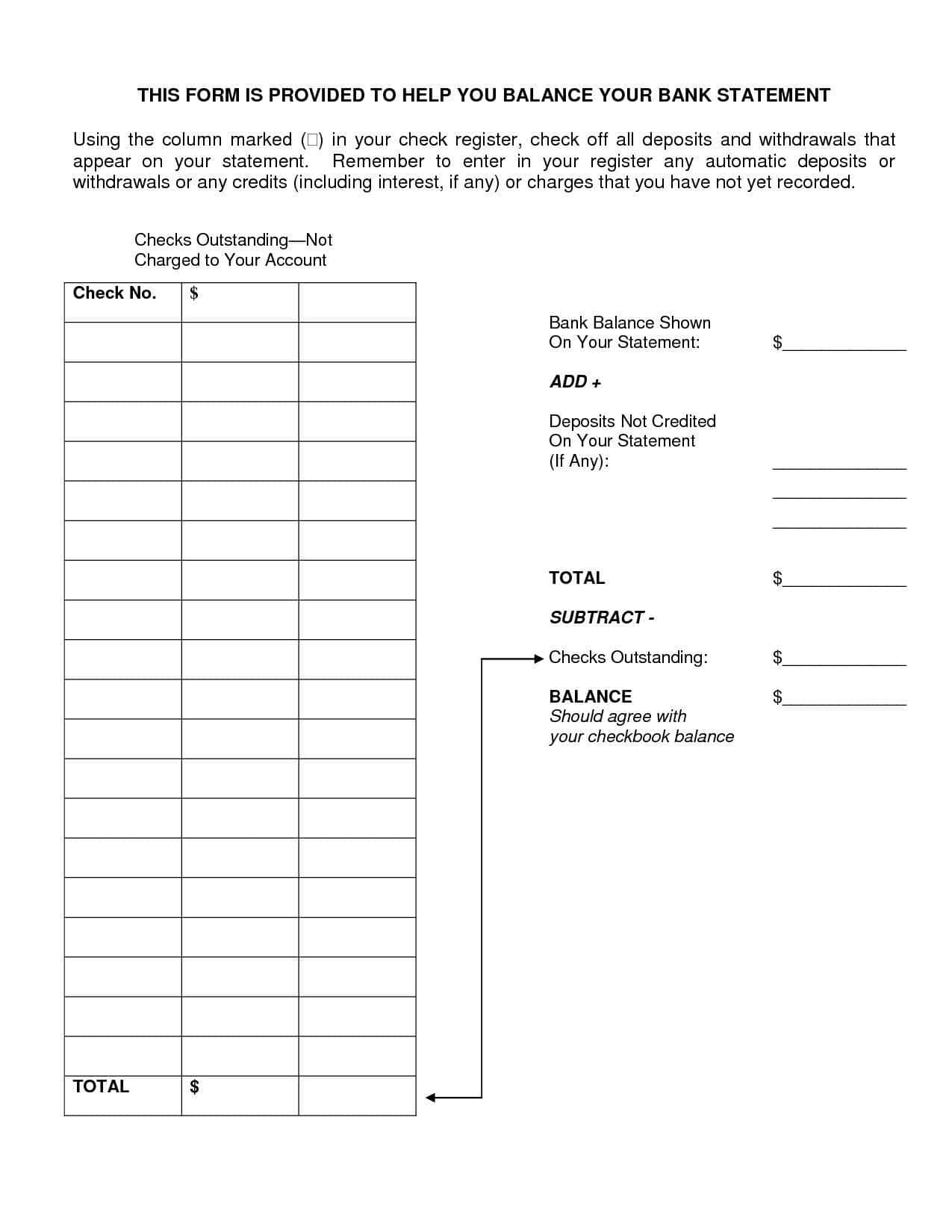

Down-payment assistance applications (DPAs) let homeowners shelter the newest initial expenses associated with purchasing property, for instance the downpayment and you will closing costs.

Centennial bank inside our area have an application and that positives all this type of professionals

Eligibility and you may standards may differ from the system, but many DPAs are made to assist basic-go out homeowners otherwise people who haven’t possessed a house much more than just three years (re-qualifying your once the a primary-big date visitors), low-to-moderate earnings family members, and individuals who work in a number of procedures, instructors, nurses, EMT, firefighter, officer. They give a loan provider borrowing to the origination charges out-of $1025. Nevertheless they render $500 credit for individuals who experience here first-date domestic visitors way. Lees verder