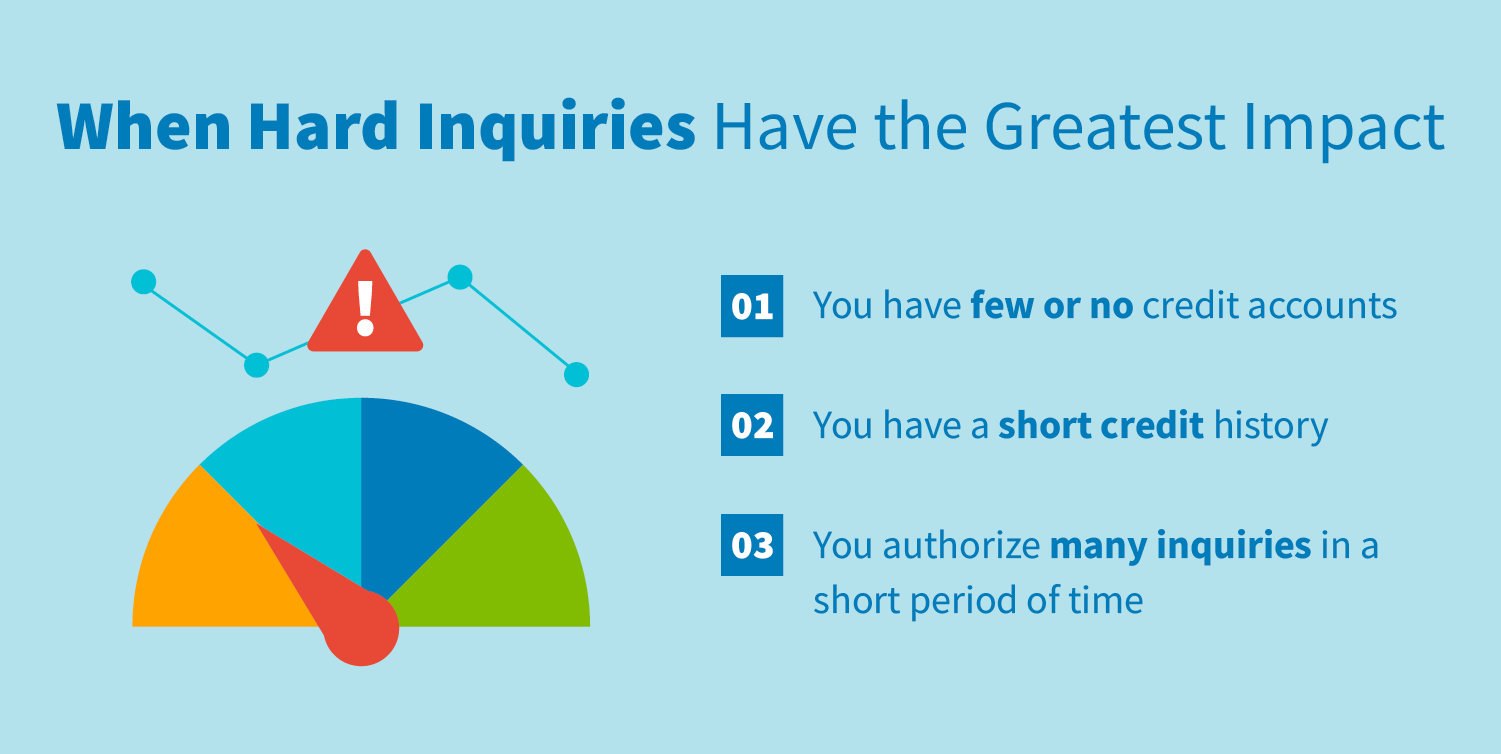

This really is a practice in which lenders promote some other rates of interest and you can loan terms and conditions based on one’s creditworthiness. Homeowners that have large fico scores will discover lower interest levels, when you are individuals with down scores you will face high costs. This system underscores the importance of good credit for home financing, because myself affects the entire price of your loan.

Your credit score was a button consider the borrowed funds app processes, impacting both the eligibility a variety of brand of finance additionally the terms you’re going to get. Expertise these types of conditions and you may where you are helps you ideal navigate their financial possibilities and you can plan effective homeownership.

In the wonderful world of mortgages, your credit rating is over simply a variety – it reflects debt health insurance and was a switch determinant for the your house-to shop for trip. Lees verder