These expenses rarely have anything to do with production and never really vary, which means they are relatively predictable. Some examples of fixed costs include insurance, property taxes, and payroll. Distinguishing between operating expenses and capital expenses is important for maintaining accurate accounting practices. It defines operating expenses as being ‘ordinary and necessary’, meaning they are commonly accepted in that industry and required for a company to conduct business.

By building long-term relationships with them, you can even get exclusive offers that will help reduce costs. Boost your confidence and master accounting skills effortlessly with quickbooks self employed vs quickbooks online CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success. Optimise supplier relationships, streamline contract management and track savings efficiently with our all-in-one procurement platform. Access and download collection of free Templates to help power your productivity and performance.

For example, companies report their gross, operating, and net profits or losses. The calculation for these items differs based on the division of various expenses. For example, the business may need to spend money on research and development, equipment purchases, a lease on office space, and employee wages. A startup often pays for these costs through business loans or money from private investors. This contrasts with operating costs, which are how much does a cpa cost paid for through revenue generated from sales. Operating costs that are high or increasing can reduce a company’s net profit.

Operating Expenses: A Comprehensive Guide to Business Cost Management

- Companies often need to lease office space or land to run their business operations.

- These costs can be fixed (such as rent) or variable (like marketing budgets), and can be either tax-deductible or non-deductible.

- Purchasing machinery, for example, is considered a capital expenditure, whereas, repair and maintenance of the machinery is considered an operating expense.

- Operating expenses are necessary costs for conducting daily business activities.

- As stated above, various prominent items appear under operating expenses.

- For instance, buying a building is typically an investing activity in most industries.

A company’s management will look for ways to stabilize or decrease operating costs while still balancing the need to manufacture goods that meet consumer demands. If operating costs become too high, management may need to increase the price of their products in order to maintain profitability. They then risk losing customers to competitors who are able to produce similar goods at a lower price point. The total cost formula combines a firm’s fixed and variable costs to produce a quantity of goods or services. To calculate the total cost, add the average fixed cost per unit to the average variable cost per unit.

Companies often need to lease office space or land to run their business operations. Along with rent, businesses also need to pay for utilities such as water, electricity, and gas. These costs are necessary to maintain a functional working environment and facilitate daily operations. The IRS treats capital expenses differently than it treats operating expenses. According to the IRS, operating expenses must be ordinary (common and accepted in the business trade) and necessary (helpful and appropriate in the business trade). In general, businesses are allowed to write off operating expenses for the year in which the expenses were incurred.

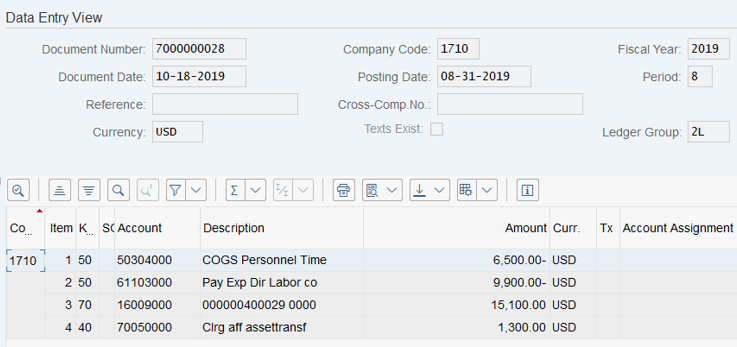

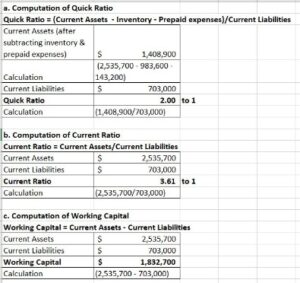

Calculating Operating Expenses

Some of the most common operating expenses include rent, insurance, marketing, and payroll. A company’s operating expenses are costs required for everyday business operations, while non-operating expenses are other costs a business incurs that are not directly related to primary business operations. The most common examples of non-operating expenses are financial costs such as loan fees and interest charges. Losses from business investments, currency exchange, legal fees, and bank fees are also non-operating expenses. An operating expense is an expense that a business incurs through its normal business operations. Often abbreviated as OpEx, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, and funds allocated for research and development.

What Is the Difference Between Operating Costs and Startup Costs?

However, non-operating expenses don’t relate to the core business activities. Instead, they come from other sources, such as financing and legal issues. Non-operating expenses appear after operating expenses in the income statement. Essentially, these costs occur regardless of the activity levels during a period. For example, they may include administrative, bench accounting review and ratings selling, marketing, or other expenses.

How To Calculate Operating Expenses

Capital expenses, or CapEx, can include things like patents, machinery, and business real estate. Operating costs are the expenses a business incurs in its normal day-to-day operations. Startup costs, on the other hand, are expenses a startup must pay as part of the process of starting its new business. Even before a business opens its doors for the first time or begins production of a new product, it will have to spend money just to get started. Generally speaking, a company’s management will seek to maximize profits for the company. Because cutting costs generally seems like an easier and more accessible way of increasing profits, managers will often be quick to choose this method.