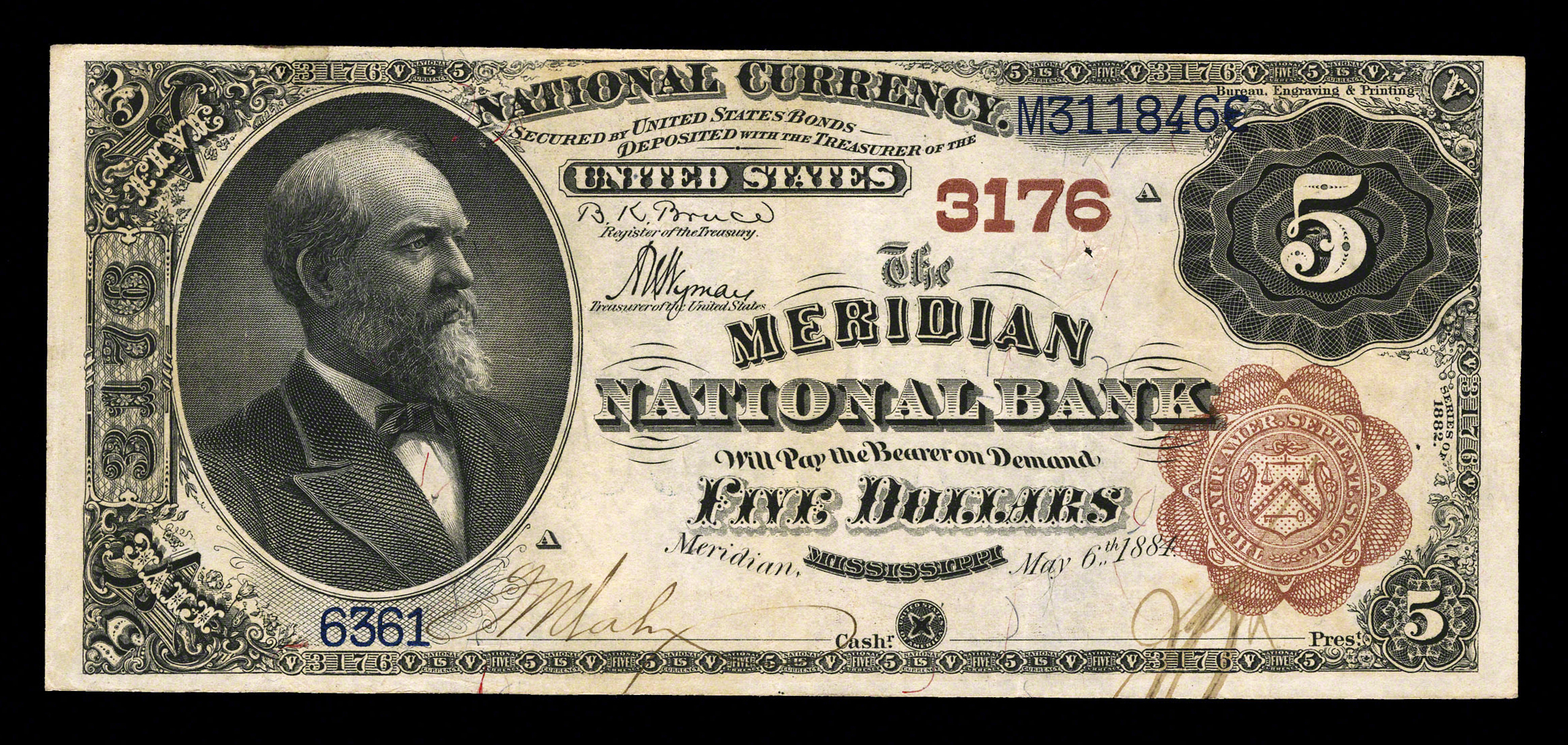

Mediocre, because of the condition

The reason behind the differences is probably related to other monetary situations. The claims into low results are among the reasonable income claims in the nation, Schulz says.

For example, median household incomes during the Mississippi, Louisiana and you may Alabama is actually $52,985, $57,852 and you can $59,609, respectively, weighed against the newest You.S. average regarding $75,149. As for Minnesota – the state leader having Credit ratings – this new median domestic earnings is actually $84,313.

Lower income can indicate that when you are able to score a great mastercard, eg, it might provides a smaller restrict than the others you will found, Schulz states. That will create much easier to maximum away a cards card, that will carry out genuine injury to your own credit.

Finest 850 FICO Score

Truth be told, some users enjoys the best 850 FICO Get, symbolizing only 1.7% of one’s You.S. people (at the time of ). But, which is more twice as much payment who achieved excellence within the (0.8%), making it good milestone that more individuals are interacting with.

The official and you will town with the large portion of finest get holders in their populace is Hawaii (dos.6%) and you will Bay area (step three.0%). 1%, because mediocre period of the eldest account was three decades dated. So it matches the latest theme men and women that have access to large amounts of credit (and you may reduced balances) and several several years of self-confident credit history (and therefore old) acquiring the finest danger of reaching the top borrowing tier.

Mediocre credit score: VantageScore

Because FICO Rating try the fresh new undisputed standard for almost all many years, VantageScore makes big strides previously years-and, Schulz states. VantageScore is a lot like FICO in a number of suggests, however, there are distinctions. For 1, the financing score range is also 3 hundred to 850, nevertheless the levels search some other:

A separate secret change would be the fact when you are FICO has separate score for each one of the credit agencies (Experian, Equifax and you may TransUnion), VantageScore is actually computed using investigation regarding all the three credit history. Indeed Vermont installment loans, VantageScore was created as the a partnership amongst the about three bureaus from inside the 2006.

Anything the score have in common is the fact that mediocre VantageScore on the You.S. is also about good assortment – 702 – since . The average VantageScore also has grown in recent years, jumping 16 circumstances (off 686) due to the fact .

Although not, simply 61% of Americans have at the very least good VantageScore (661 or top), compared with 71.3% with at least a beneficial FICO Rating (670 otherwise most readily useful). Yet ,, the newest fee which have an excellent VantageScore – 23% – is higher than individuals with a superb FICO Get (21.2%). Yet not, you ought to observe that VantageScore keeps a greater get variety in the the major.

Mediocre, of the years and you will battle

Just as with FICO, big date is on your own side when it comes to VantageScore, though baby boomers slightly border out of the hushed generation, 740 to help you 738. Although not, little one boomers’ mediocre is a lot before Gen Zers’ (663), that is just a hair to your a range.

Yet not, you will find big VantageScore disparities with respect to race. According to Metropolitan Institute, the fresh median credit score inside bulk white teams was 100 things greater than inside bulk Black colored groups – 727 (good) in the place of 627 (fair). Most Hispanic communities come in the middle, averaging 667, if you’re most Indigenous Western teams are at the bottom, averaging 612, according to data.

It can be an excellent trickle-off effect away from generations off endemic monetary barriers. According to the Joint Center getting Casing Education on Harvard School, Black colored Us citizens is less inclined to feel people, having a 41.7% homeownership price around the world – 31 payment products below white properties. Expenses rent on time could be maybe not stated while the a confident craft into the credit file (unless you proactively fool around with a rent-revealing provider), when you find yourself purchasing a mortgage becomes advertised.