One may be turned-down to have a beneficial Va mortgage, even though you meet the government’s lowest assistance having system eligibility. Fulfilling the fresh new Department’s requirements is not sufficient. These are the primary circumstances with regards to qualifying to possess an effective Va mortgage now.

Va Credit ratings: As previously mentioned prior to, the new Agency out of Pros Situations has no certain standards to possess credit ratings. You could be sure the lending company do, and that can differ from just one bank to another location. Really financial institutions and you will lenders need a credit history off 600 to be accepted. But not, this doesn’t guarantee mortgage approval as there are wishing episodes getting people having previous financial difficulties particularly foreclosure, personal bankruptcy, etcetera.

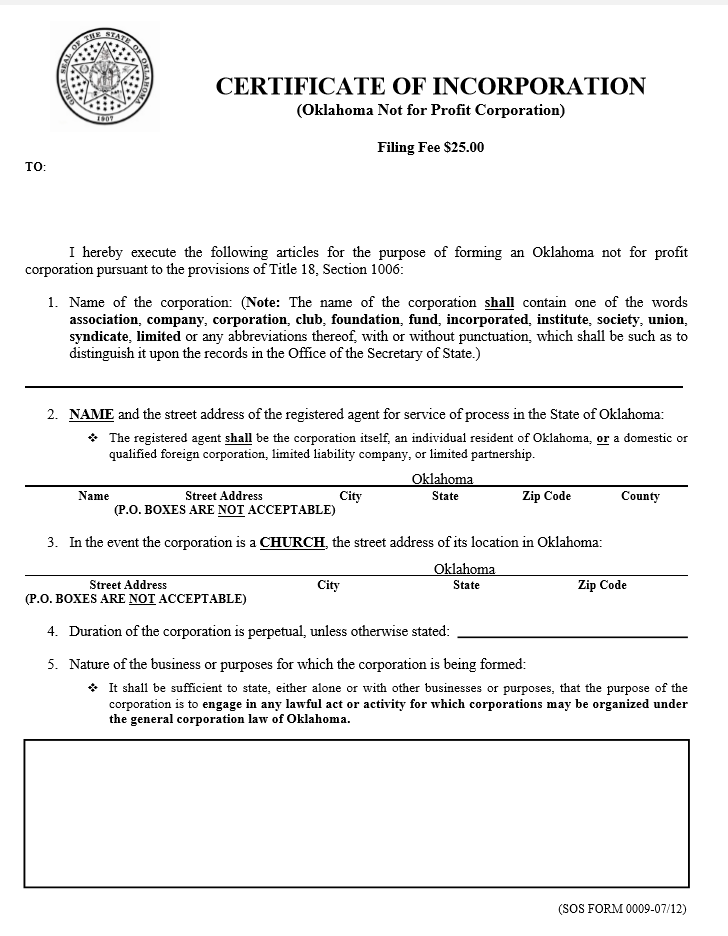

Data needed for Va capital usually through the Certification out of Qualification (COE), the newest Consistent Residential Loan application (URLA), bank statements, tax returns and you may W-2 variations, this new DD Form 214 to own experts that have kept the fresh new military, and you can many different basic Virtual assistant data

The minimum borrowing requirements plus confidence the latest down-payment number. If the a borrower earnings 100% the financing requisite was more than a borrower who has got a great 5% otherwise 10% downpayment. On the bright side, some consumers with lower loans, an such like could well be approved having slightly shorter credit scores.

Va A job Records: Like any home loans now, Va will demand a reliable a few-season a career record no highest trips during the a position

Switching employers is sometimes ok, provided there was no high gap from one jobs to another location. Consumers one to discovered purely impairment or public defense earnings try exempt from this code. Yet not, they need to bring adequate documents taking continuance of these income.

Va Obligations-To-Money rates: The fresh Va obligations-to-income proportion, or DTI, is an additional crucial Virtual assistant financing requirements. That is a comparison within sum of money you have made (disgusting month-to-month income) and also the amount you to definitely goes toward the repaired monthly expenses (repeating debts). Usually, your own complete DTI proportion, for instance the family fee, cannot exceed 43%.

So it needs is actually enforced of the lender, not by Virtual assistant. That it varies from one mortgage lender to another. Exclusions are made for borrowers that have sophisticated borrowing, significant savings regarding the financial, an such like. Loan providers and you can brokers phone call these types of solid compensating facts of loan Money will come away from multiple provide plus however online installment loans Vermont simply for base military shell out, non-military a job, profits, self-working money (min dos-12 months history) old age earnings, wife or husband’s money, and you will alimony.

Virtual assistant Financial Data: When it comes to Virtual assistant financial criteria, paperwork is key. Banking institutions and loan providers commonly consult many data to verify your income and you will possessions, as well as your most recent personal debt condition. Nonetheless they must verify and you can document your capability to repay the mortgage, in line with brand new lending conditions. If you’d like recommendations finding these data files, we can let. Just e mail us 7 days a week.

Virtual assistant Occupancy (Primary Residential property): New Va also offers certain conditions getting occupancy reputation. Quite simply, you ought to utilize the domestic since your pri to finance the fresh purchase of a good investment otherwise trips (next house) possessions.

Va Assessment: Just like any most other mortgage system, this new Company off Pros Things needs all of the property becoming ordered that have good Virtual assistant mortgage to go through a home assessment. This is where a licensed appraiser evaluates your house to determine simply how much its value in the present sector. Generally, the house should be really worth the matter you really have provided to pay for it, also it dont meet or exceed brand new Va financing limitation towards the condition in which its discovered. Our house have to be sufficient equity to your expected mortgage, according to the Agency. Excite contact us to go over the fresh Va loan buy restrict within the your own area.