Getting financing having a 540 credit rating was challenging. Your odds of getting rejected was highest given a loan provider usually think a beneficial 540 credit rating become increased chance. However, even with how challenging it can be, you could secure that loan having a good 540 credit history. These types of financing will require a whole lot more small print to be satisfied.

- Have a good co-signer otherwise guarantor of financing. If the for some reason your really standard, the newest co-signer and you can/or guarantor was held responsible into the outstanding equilibrium.

- Need a higher rate of interest. Rates of interest are what a lender fees one to use its money. When you have good credit score, loan providers think you a lowered chance and does not need certainly to build as much cash on your. When you have good 540 credit rating, you are noticed a higher risk and you can a lender have a tendency to charges you a high rate of interest to help you validate trying out such as for example a beneficial higher exposure.

- Concurrently, if you would like get a loan which have a 540 borrowing from the bank score, be ready to build a bigger down-payment. A top advance payment besides reduces the amount of money you are inquiring to acquire, in addition it suggests a lender you are purchased the acquisition you are making. For people who part means with plenty of money having an excellent high deposit, it can be secure to visualize you don’t want so you’re able to standard thereon financing and also have the item repossessed – as you would certainly be from the higher deposit if that happened.

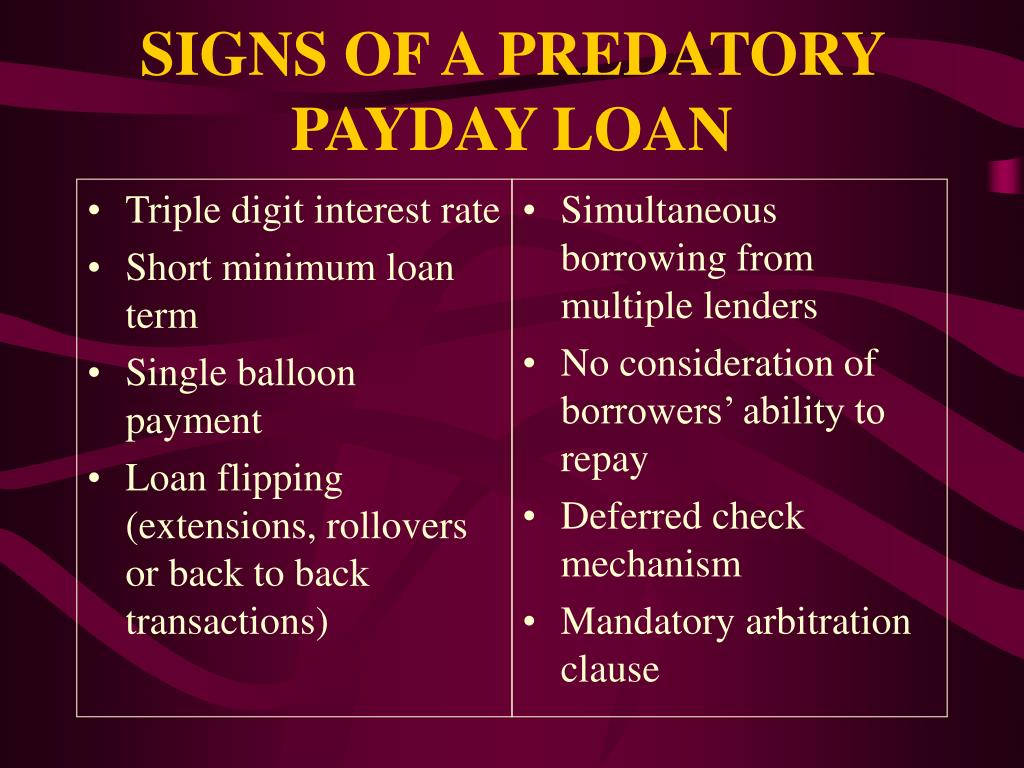

Various funds are available to individuals with good 540 credit rating. not, payday loans are going to be avoided without exceptions. Examine several of the most popular options less than.

Secure bank card

A secured bank card is when new account proprietor, or cardholder, dumps currency to open up a secured charge card. Rather than a frequent credit card, which is awarded on your own credit score, a secured bank card will demand the brand new cardholder giving an excellent deposit in order to be granted this new cards. So it deposit is going to be a couple of hundred bucks and you may generally minimizes the chance the financing bank performs. Whether your cardholder don’t spend its mastercard balance, the credit card company keeps the initial deposit.

Borrowing creator loan

A cards-strengthening mortgage try a loan that can help people with bad credit score boost their borrowing. Instead of a traditional mortgage, where in fact the cash is supplied to the brand new borrower, a cards-building loan necessitates the borrower to pay a predetermined percentage to own a specific time period. Once the borrower helps make all of their costs and you will meets the newest loans of one’s title, the financial institution factors the borrower the money. That it just lets new debtor to build their credit rating as well as lets this new borrower to build coupons.

Auto loans

No matter if getting an auto loan are tricky with an effective 540 credit rating, you are able. A loan provider typically takes into account an auto loan for the less risky spectrum because it is supported by a valuable asset, the vehicle. If your borrower non-payments towards mortgage, new lien holder can repossess the auto. When you’re making an https://elitecashadvance.com/payday-loans-mo/ application for a car loan having good 540 borrowing from the bank score, expect to pay increased rate of interest and you will charge.

Suggestions to replace your 540 credit score

When you have a good 540 credit history, do not get discouraged! Your credit score is permanently swinging, and just because your credit score is lowest now does not mean it ought to remain reasonable. You can need deliberate tips to switch your credit rating.