Restrict loan limitations vary by state

- Sms

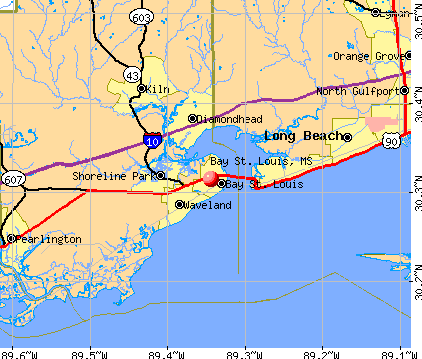

A chart of your own All of us showing Point 184 mortgage approvals when you look at the per condition at the time of , the most recent chart the fresh new Casing and you may Urban Invention provides. Housing And you may Metropolitan Invention

Restrict loan restrictions vary because of the state

- Texting

- Print Backup blog post hook up

Maximum loan limits differ because of the condition

- Text messages

- Printing Copy blog post link

TAHLEQUAH, Okla. — Of a lot Indigenous Us citizens could possibly get be eligible for home loans via good You.S. Houses and you will Metropolitan Invention program that’s lived for more than several years. The new Section 184 Indian Mortgage Be sure System enjoys versatile underwriting, isn’t really borrowing from the bank-rating created which will be Local-particular.

Congress based it inside the 1992 to support homeownership within the Indian Nation, and many of its professionals are low-down repayments no individual mortgage insurance coverage.

“I simply thought its good system, and that i purchased personal domestic doing so,” Angi Hayes, financing creator getting initially Tribal Credit when you look at the Tahlequah, said. “I just think it’s very great, (a) program more anyone should become aware of and without a doubt the fresh people should become aware of.”

“Where I really works, we’re one particular loans Collinsville knowledgeable nationwide, for example we would a whole lot more (184 financing) than most likely all other bank,” Hayes told you. “There are lots of factors that it’s most likely much better than FHA (Federal Housing Management), USDA (U.S. Agency regarding Agriculture) otherwise traditional loan. A lot of times its lesser up front. For example, FHA is going to charge you step three.5 per cent down. We fees dos.25 %.”

Hayes told you into the Oklahoma the maximum mortgage she will be able to already promote is $271,050. “The new debtor was exposing that most other 2.25 percent, so the $271,050 is not the biggest purchase price you could have, it is simply the most significant loan amount I can manage.”

“That’s probably the most significant misconception toward 184 loan, that always are a part of your own group or having status since the Indigenous Western, they often tend to be the lowest otherwise moderate-money state,” she said. “The beautiful most important factor of brand new 184 is the fact this is simply not low-money and is also not merely to have very first-day homebuyers.”

Hayes told you if you’re HUD has no need for a specific credit history so you’re able to meet the requirements, she means a credit file to decide a keen applicant’s obligations-to-income proportion. She together with need spend stubs, income tax and you can financial comments as well as least a few different credit having 12 months property value adopting the.

“I could give people I am not saying a credit specialist, however, due to the way we perform the approvals, whenever i remove borrowing I’m looking at the meat of statement,” she said. “Generally, you place your income and obligations in your credit history and you also add it to the fresh new suggested domestic percentage. These one thing to one another cannot be more 41 per cent out of the total gross income. Which is the way i regulate how much you are acknowledged getting.”

“I am finding no late payments within the last one year,” she said. “Judgments, you ought to be couple of years outside of the big date it is filed and you may paid off. We want zero collections that have stability if you don’t features evidence one you have repaid about 1 year inside. If you’d like to view it good sense, the thing i share with someone is that we do not need to hold your own bad history up against your.”

This new 184 loan likewise has a reduced downpayment dependence on dos.25 % having finance more $50,000 and step one.25 percent to possess funds below $fifty,000 and you will costs .25 percent a year to have private home loan insurance rates. As loan well worth are at 78 %, the insurance are going to be fell. The buyer together with will pay one, step 1.5 percent financing fee, which will be paid in dollars it is always additional to your the borrowed funds count.

“If i has actually people walk in, We earliest need certainly to find out what the requires are,” she told you. “In the event the consumers must pertain by themselves, I will let them have the equipment that they must know while they are prepared to pick. Once they only want to create an even get, I very suggest individuals to get pre-recognized prior to they start looking on possessions, given that they may be looking at something that is actually way more otherwise way not as much as its finances.”

The mortgage may also be used so you can re-finance a preexisting family home loan, Shay Smith, movie director of the tribe’s Small business Guidance Cardiovascular system, said.

An alternate appeal is that it may be shared with the tribe’s Home loan Guidance Program to possess house sales. The fresh new Chart helps customers get ready for homeownership having custom borrowing from the bank instructions and you can class studies while offering deposit assistance between $10,000 to help you $20,000 getting first time homebuyers. Yet not, Map individuals have to satisfy money guidance, getting first-date homebuyers, finish the called for records and applications and you can complete the homebuyer’s training categories.

Any office out of Mortgage Be certain that contained in this HUD’s Workplace out of Native Western Apps guarantees the latest Area 184 mortgage loan finance designed to Native individuals. The loan ensure assurances the lender one to its investment was paid completely in the eventuality of property foreclosure.

The borrower is applicable on the Area 184 mortgage having a playing bank, and you can works closely with brand new group and Agency off Indian Activities if rental tribal land. The lender following evaluates the required loan files and you may submits the latest loan to possess approval so you can HUD’s Place of work out of Mortgage Guarantee.

The mortgage is limited in order to solitary-family property (1-cuatro devices), and you may fixed-rates financing for thirty years of faster. None adjustable speed mortgage loans (ARMs) neither industrial property meet the criteria having Area 184 loans.

Loans must be manufactured in an eligible area. The application form has grown to provide qualified parts past tribal faith residential property.