Having property in the present life is its a matter of higher conclusion, and receiving a home loan ’s the very first action with the home ownership. A significant concern provides coming towards the heads regarding household-loan individuals: how much cash do they really acquire purchasing a home?

Within this blog post, we’re going to talk about the circumstances one to dictate your property financing. We’ll in addition to safety an example of a mortgage Amortization Program as well as the activities you’ll be able to deal with. We will additionally be organizing exactly how Brick & Bolt can assist you to construct your dream family even inside your financial opportunities .

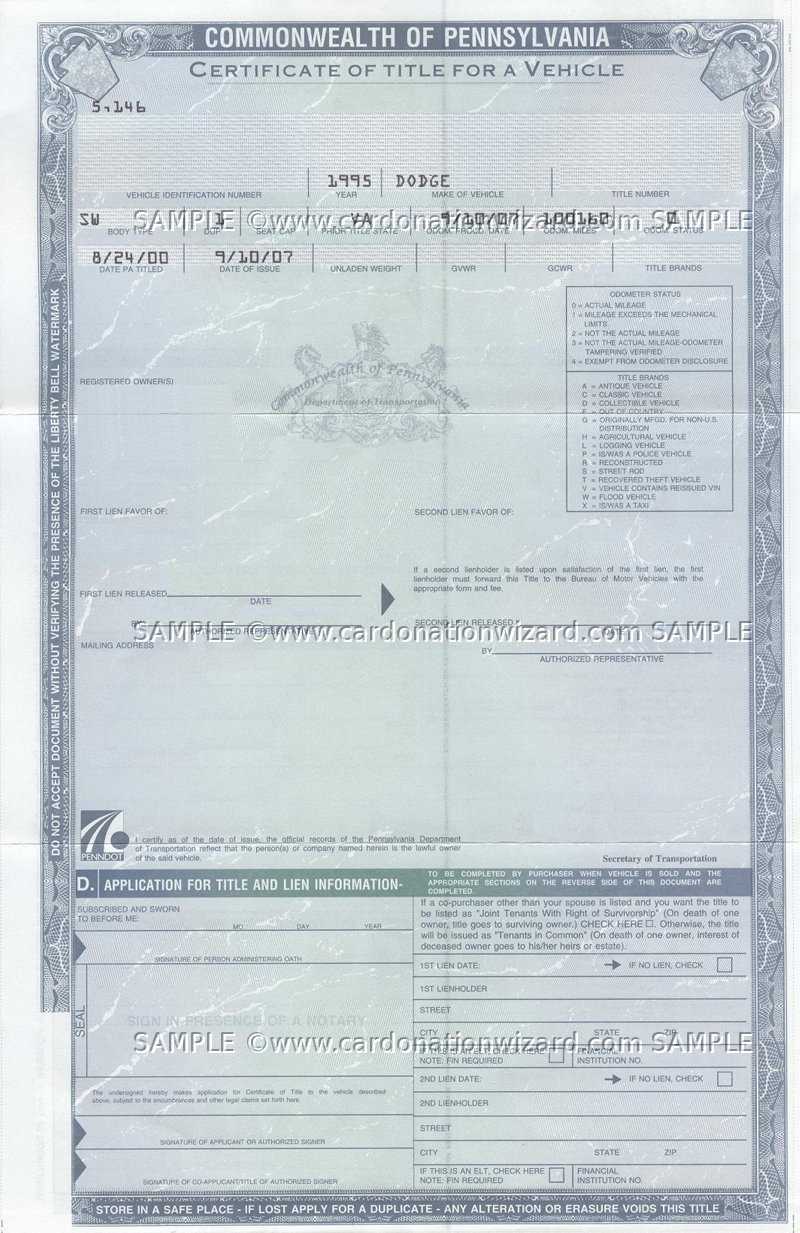

Consider a good example of a mortgage of Rs. 50,00,000 having a period of 25 years on mortgage loan out-of 8.5%. We have found a sample amortization schedule getting a monthly EMI off Rs. 31,000.

So it dining table portrays how the prominent and you can appeal money change over the mortgage period. Have fun with a keen EMI calculator to estimate your monthly premiums predicated on the loan matter and you can period.

step one. Performs Sense:

Work records credit approvals to own home loans rely much more about this new newest earnings from a career, and those who was in fact useful for at least per year or one or two rating preferred.

dos. Age:

Are you aware that general conditions of your finance companies, applicants should be within ages of 21 and you will 65 years to seek mortgage brokers.

step three. Credit history:

This will be an important factor just like the the absolute minimum credit score of 750 escalates the probability of a loan being approved and may also end up in ideal interest levels.

cuatro. LTV (Mortgage to Value):

Even though high LTV percentages can cause large credit numbers, they arrive having increased interest as well. LTV is actually a standard getting home financing, in which all financial institutions provides an optimum LTV off 90 per cent.

5. FOIR (Fixed Obligations-to-Money Ratio):

Lenders fundamentally follow an effective FOIR as much as 50% getting lenders. When you yourself have present bills, purchasing all of them out of and you may keeping those individuals numbers reasonable is vital getting good FOIR.

six. Property’s Legal:

Having a reasonable courtroom label of the property and receiving recognition throughout the server government is required to possess loan anticipate.

Home loan Challenges with the ?60k Paycheck

Towards matter in order to become more comfortable for residents, especially protecting a home loan for the an Rs. 60,000 paycheck are smoother weighed against a lowered one; although not, there is certainly a great deal more questions after that on account of highest assets pricing for the majority urban centers. To overcome these types of demands, consider:

The second function is the fact that borrower pays a high down percentage to cut back the dimensions of the loan and keep maintaining sensible rates for the EMIs.

One method to increase financing credit worthiness is via applying towards loan jointly with your companion or one relative of your preference.

Exactly how Brick & Bolt Can help you Generate a house

Stone & Bolt, in addition to several options suggested, support shed committed and you may costs needed to generate a home whenever you are promising large-quality performs. The services are:

Providing a set of home patterns and enabling the purchasers in order to select all of them predicated on its possibilities and you may inside set budget.

Coordinating towards framework contractors in order Florida installment loan to oversee new improvements of one’s construction to meet the newest booked time and quality criteria.

Brick & Bolt helps clients carry out its economic balance more effectively, as they can build a house which have a lesser amount borrowed compared to conventional design procedures.

You will have the things regarding strengthening such great homes looked after by Brick & Bolt as you tackle issues regarding your financial balance.

Conclusion

Before you apply for home financing it’s important to take into account the degree as well as the budget you are ready to put on the fresh line. Think about the troubles and you will glance at choice for example co-application and you will assistance having simple execution out of people such as for instance Stone & Bolt to eliminate complete pain on acquisition of a home.