They actually do sound since if these are generally comparable, a house examination and you will a property appraisal. And you will yes, various other people manage indeed visit and you can search the house, however for several entirely other motives.

The first difference between an effective Va review and you may a good Va assessment is the fact an assessment isnt a requirement for good Va financing. In reality, a home check is not a necessity on people home loan. Particular says create want an examination for termites and other wood-ruining bugs, however, a property assessment critiques the fresh skeleton of the home.

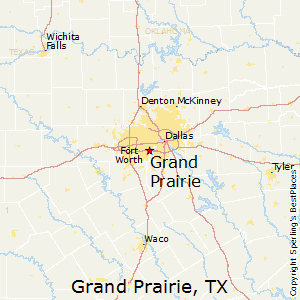

An assessment required to ensure most mortgage brokers into the Columbia while making a loan recognition. When a binding agreement is actually decideded upon ranging from a provider and a great consumer, the sales bargain are forwarded into bank exactly who up coming sales a house assessment.

The fresh appraisal’s duty will be to determine the subject property’s economy worth. No matter what product sales contract states, brand new Virtual assistant financial will always utilize the lower of your own conversion price otherwise appraised value whenever starting a maximum loan amount.

A keen appraiser will in person visit the possessions in addition to lookup advice for similar residential property in the area and you may contrast its conversion process cost into conversion process price of these devices. A great Va financial really wants to have a marketable assets as well since the make sure the house is offered to own a reasonable price. If there is a variance greater than 10 percent when you look at the product sales cost of city land anyway improvements are made, the very last sales rate can be lower.

Basically, the house or property review evaluates the brand new property’s shape due to the fact assets appraisal facilitate establish the present day market value.

Va Minimum Assets Requirements 2022

Yet not, Virtual assistant appraisals request much more information that is not necessary for almost every other mortgage models. The fresh new Va keeps a set of minimal assets requirements (MPRs) that the appraiser need certainly to envision and provide throughout the appraisal declaration. Preciselywhat are some situations regarding MPRs?

The original standards is the fact that the property be residential as opposed to commercial, and that it be occupied by debtor. The property might also want to have compatible way of life rentals, along with an operating cooking area, toilet, and bedrooms, according to appraiser.

Electrical and you may plumbing work systems, plus a working home heating and warm water, need to be in an excellent https://paydayloanalabama.com/langston/ performing buy. New roof is additionally assessed according to Virtual assistant advice, and you can instead of most other assessment items, in the event the assessor discovers more than three levels from shingles on the the fresh rooftop, the complete roof have to be replaced.

The newest Va appraiser might note if or not you can find one dangerous products on the possessions assuming the structure displays zero periods of poor workmanship otherwise neglect, such as for example a broken base or a wet cellar. If the home is created in advance of 1978, it ought to be looked at to have lead-created paint and you may, if seen, new offensive painting should be removed otherwise wrapped in drywall or other permanent boost, much like almost every other bodies-backed funds. New Va research is far more comprehensive than many other analysis, such as those having antique financing passed by Federal national mortgage association otherwise Freddie Mac. Indeed, new rigour regarding good Va assessment along side property check provides eliminated potential Virtual assistant consumers off to find qualities that will be inside bad position. The newest strategies are located in place to include the fresh borrower, to not ever merely avoid an earnings price.

Va Financial Assessment Criteria

The newest Va first monitors to find out if the home possess first property access. It needs to be reachable of the a community otherwise individual street that have a just about all-climate skin. You really must be able to get to they in the place of trespassing into the other’s assets. Indeed there must also be sufficient room surrounding the unit to let for your expected outside wall surface solutions.